Avoiding Costly Tax Filing Mistakes: A Case Study for Filipino SMEs (Achieving 100% Accuracy in Under 2 Weeks)

Many small and medium-sized enterprises (SMEs) in the Philippines face significant challenges during tax season. This case study details the common tax filing mistakes encountered by Filipino SMEs and demonstrates how Upcloud Accounting helped one client achieve 100% accuracy in their tax filings within two weeks. We'll outline our strategies, step-by-step process, and the impressive results achieved.

PRIMARY CHALLENGE: Our client, a rapidly growing online retail business, struggled with inconsistent bookkeeping practices, leading to inaccurate financial records and a high risk of tax penalties. They lacked the internal expertise to navigate the complexities of Philippine tax regulations. Their primary concern was avoiding costly errors and ensuring compliance with BIR regulations.

MAIN OBJECTIVES: Our main objectives were threefold:

Establish Accurate Financial Records: Implement a robust bookkeeping system to ensure accurate and up-to-date financial data.

Ensure Tax Compliance: Prepare accurate tax returns in compliance with all relevant BIR regulations.

Minimize Tax Liabilities: Optimize tax deductions and minimize potential tax penalties.

HOW-TO DETAILS:

Onboarding and Assessment: We began with a thorough assessment of the client's existing financial records. This involved reviewing bank statements, invoices, receipts, and other relevant documents. We identified inconsistencies and areas needing improvement.

Bookkeeping System Implementation: We implemented a cloud-based accounting system, providing real-time access to financial data. This system automated many tasks, reducing manual effort and the risk of human error. We trained the client's staff on using the system effectively.

Data Reconciliation and Cleaning: We meticulously reconciled bank statements with the client's accounting records, identifying and correcting discrepancies. We cleaned and organized the financial data, ensuring its accuracy and reliability.

Tax Return Preparation: Using the accurate and organized financial data, we prepared the client's tax returns, ensuring compliance with all relevant BIR regulations. We carefully reviewed all deductions and credits to minimize tax liabilities.

BIR Filing and Compliance: We filed the tax returns electronically with the BIR, ensuring timely submission and compliance with all filing requirements. We also provided ongoing support to address any questions or concerns.

THE RESULTS:

100% Accuracy: Our meticulous approach resulted in 100% accurate tax returns, eliminating the risk of penalties and audits.

Time Savings: The process, including data cleaning, reconciliation, and filing, was completed within two weeks, significantly reducing the client's workload.

Reduced Stress: The client experienced a significant reduction in stress associated with tax filing, allowing them to focus on their core business operations.

Improved Financial Visibility: The cloud-based accounting system provided the client with real-time access to their financial data, improving their financial visibility and decision-making capabilities.

IN CONCLUSION: By implementing a robust bookkeeping system, meticulously cleaning and reconciling financial data, and ensuring strict adherence to BIR regulations, Upcloud Accounting helped our client achieve 100% accuracy in their tax filings within two weeks. This case study highlights the importance of accurate bookkeeping and professional tax assistance for Filipino SMEs seeking to minimize tax liabilities and maximize efficiency. Contact us today to learn how we can help your business!

Upcloud Accounting

Virtual Outsourced Accounting and Bookkeeping Services in the Philippines

Our goal is to increase efficiency, automation, and transparency across the accounting and finance functions of our clients with our cutting-edge technology.

If you want to move your company’s finance function online, contact our Team of Expert Accountants and Bookkeepers directly via [email protected] or visit www.upcloudaccounting.com to learn more about how Upcloud Accounting accounting services can support your PH business!

Disclaimer: This article or blog is only for general knowledge and guidance and is not a substitute for an expert opinion. For technical advice, please consult your tax / legal advisor for your specific business concerns. For comments, suggestions, and feedback, feel free to email us at [email protected]

Click the button below to schedule a FREE online consultation with us.

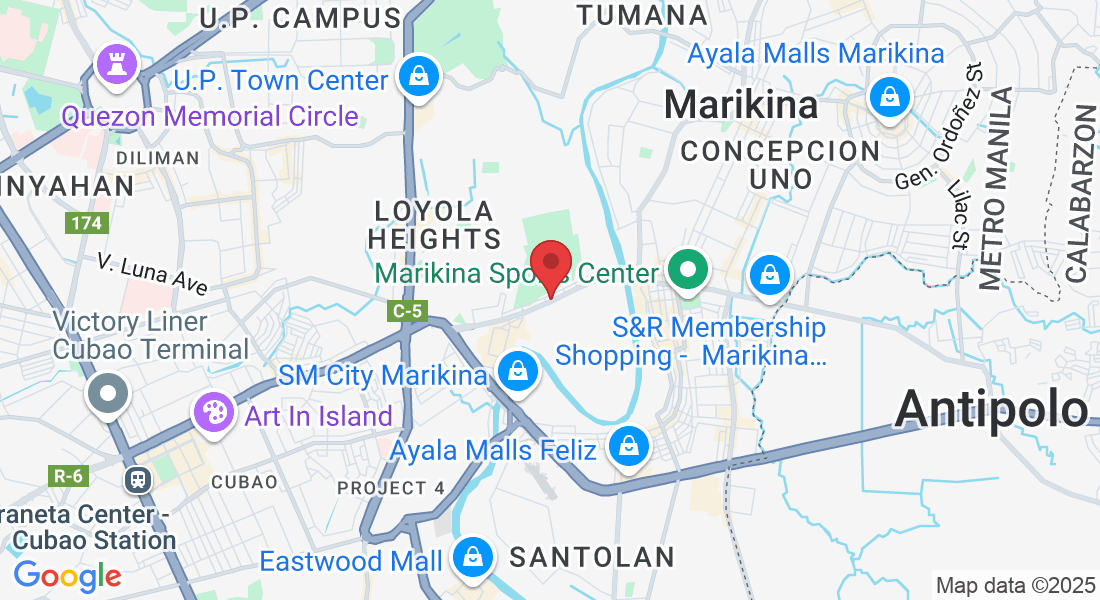

Address

Unit 202 Rhodora Building, 179 A. Bonifacio Avenue, Tañong, Marikina City, 1803